Brexit-Related Fees & Your Packhelp Order

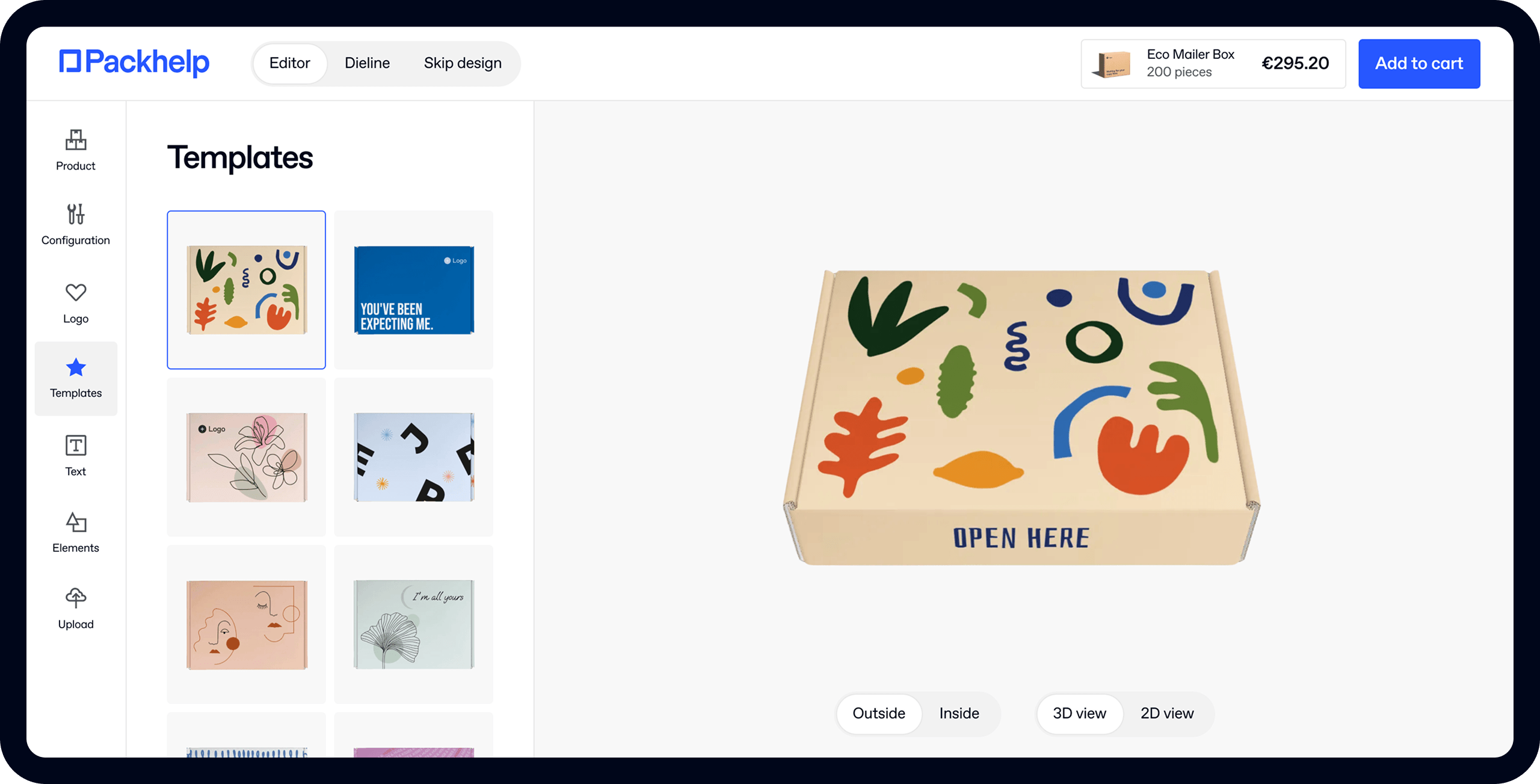

- 200+ templates & patterns

- Real time 3D packaging preview

- Upload logo and choose brand colours

Subscribe now! Receive 15% discount.

Don’t miss out – get 15% off your first order when you join the newsletter. It’s fast, free, and kinda smart.

You're now subscribed!

In this article:

At the start of 2021, the UK imposed fees and tariffs on goods imported into the UK from abroad as part of the Brexit deal.

As an EU-based business, our goods are subject to these fees and tariffs upon arrival in the UK.

If your ordering packaging with Packhelp and having it delivered to the UK, here's what you need to know:

- Packhelp is an EU-based company

- Packhelp goods are sent from the EU into the UK.

- Packhelp does not automatically collect import taxes or duties.

- Packhelp will not charge you for any border-related fees or taxes during our checkout process.

- We are obliged to issue an invoice with 0% export VAT for all our UK clients. It means you do not have to pay Polish tax rate (23%) when you are ordering from us.

- You should expect handling fees and 20% import VAT (UK tax rate) to be charged by the courier company after the goods arrive in the UK.

- For some types of shipments, we will need your EORI number.

- Packhelp ships your packaging on the Incoterm 2020 DAP basis.

How to pay your fees before your goods are shipped

To make the delivery process as smooth as possible, you may want to consider paying your import fees through Packhelp.

To do this, please reach out to our customer support team once you've placed your order.

We're working hard to make this process as smooth and automated as possible.

For the time being, we'll manually calculate, collect and pay your import fees and tariffs, should you ask us to do so.

UK companies with a UK VAT number

You will be able to claim the 20% VAT import tax.

To do so, please remember to fill out your UK VAT number during the checkout process to be invoiced as a B2B customer.

As a B2B type of client, you can also ask to postpone your VAT. You will find more information here:

Information about postponed VAT accounting

Get in touch

We're happy to assist you in any way, shape or form with the import of your order into the UK.

Don't hesitate to reach out to our team via online chat or on our contact page.

Examples

A) B2C Client + Package:

Katie bought 700 small boxes. The total amount of her order is 400 GBP net. Her boxes will be packed in 3 packages and shipped using UPS Courier company. The expected delivery time to the UK is 4-6 days.

Katie will be contacted by the courier company when packages cross the border because they will require payment for fees and the tax:

- brokerage charges (commission) - minimum 11,5 GBP/shipment or 2,5% from the order - whatever is greater

- border fee - 6 GBP/shipment

- entry fee - 6 GBP/shipment

- import VAT - 20% of the total amount of the order - 80 GBP

In our example, Katie will pay 102,5 GBP. She will be able to do it via the UPS tracking website. There is also a risk of additional charges for warehouse packages and custom clearance processes, but such cases are treated separately.

Katie does not have a company, so she is a B2C type of client. She will not be able to deduct the tax paid for this order in the tax declaration. B2C clients do not have this option - only B2B can deduct the VAT in their tax declarations.

Packhelp did not need her EORI number for the order because it was not greater than 600 GBP.

B) Pallet Client

Emma is a B2B type of client. She bought 1500 boxes which will be shipped on one pallet. Her order value is 2500 GBP. The expected delivery time for pallet shipments is one week.

Emma’s products are shipped on the pallet, therefore we need her EORI number (both B2B and B2C clients can apply for it, for free). Emma will also be asked to fill in a Power of Attorney document, before the physical shipping. It is required by the courier companies in case of any pallet shipments. Our Customer Support will contact Emma and ask for this document if necessary.

Additionally, Emma has a deferment number. Thanks to it, she will pay 50 GBP less, since the courier provision will not be added to the general charges. It also means that Emma applied for postponed VAT and will settle the charges directly with HMRC on her own.

Normally, the fee of 50 GBP (or 4% of the total shipment value- whichever is greater) is added to the final amount, as a courier provision as a broker in this process. However, for this exact shipment, Emma will pay only two kinds of fees:

- handling fee - 45 GBP / shipment

- 20% import VAT - 500 GBP

The total amount of 545 GBP can be paid by cash during the delivery or via bank transfer when the courier company issues an invoice. Emma will be able to deduct the VAT in her tax declaration.