Unpacking the UK plastic tax – and how to beat it with smarter packaging

Subscribe now! Receive 5% discount.

By signing up for our newsletter and you’ll get 5% off your first order.

You're now subscribed!

In this article:

The UK government announced another plastic tax in March to come into effect on 1 April 2022. This time the new Plastic Packaging Tax (PPT) will target all non-recycled plastic packaging. Will it spell trouble for your business? Or could it be an opportunity to make your packaging leaner and greener? Let’s see.

First, it was plastic carrier bags with the Plastic Bag Tax in 2015. Now, the UK government is waging war against all new plastic packaging with a £200 per tonne levy.

It comes as the EU, California and other governments are pursuing a similar course.

And it’s not just petroleum-based plastic. Even compostable and biodegradable plastic will be affected.

But let’s face it. This transition has been in the making for a long time. A quick look at the environmental impact of plastic packaging will tell you that:

- An estimated half of the 380 million tonnes of plastic we produce each year is single-use plastic;

- Around 8 million metric tonnes of plastic waste is dumped into our oceans every year;

- And one million marine animals are killed by plastic waste each year.

No one likes taxes, levies or whatever you want to call it. There will be some pain at first. But there may also be a silver lining.

By following the two Rs of sustainable packaging, your company can optimise your packaging supply while minimising costs, both on your budget and the environment.

In this explainer article, we’ll be looking at:

-

How and why the Plastic Packaging Tax (PPT) came about

-

What is taxed and how

-

Who will pay the PPT

-

Who/what will be exempt from the tax

-

What does it mean for your business

-

How to beat the tax by optimising your packaging

-

The PPT in a nutshell

It all started with the Plastic Bag Tax

On 5 October 2015, the UK’s Plastic Bag Tax was implemented with a 5p charge on single-use plastic carrier bags. That levy was bumped up to 10p on 21 May 2021.

Since 2015, the use of plastic bags in England has dropped by a whopping 95%.

It helped to change both consumer behaviour and business practices, as well as see the UK record increased levels of recycling. The plastic went out and in came multiple-use custom tote bags and recyclable paper bags.

The Plastic Bag Tax paved the way for the upcoming PPT.

What exactly does this plastic tax entail?

There are two key features of the Plastic Packaging Tax to keep in mind: the 30% threshold and weight as the main determinant.

The 30% recycled content test

Firstly, at this stage, the tax is not designed to eradicate all plastic packaging. The UK government itself acknowledges the benefits of some forms of plastic packaging.

It’s a durable and lightweight packaging solution, which can equate to a relatively lower carbon footprint on the distribution chain.

It’s the production of new and single-use plastic that the PPT is targeting.

Why?

For the simple fact that the production of new plastic has a greater impact on the environment than recycled plastic. The extraction and processing of raw materials require considerable energy, resulting in carbon emissions.

It's hoped that the tax will have a double-pronged effect: it will lead to both an increase in the collection of plastic waste and the production of recycled plastic packaging.

It is estimated that the tax could increase the use of recycled plastic packaging by 40%.

That would equate to a reduction of 200,000 tonnes in carbon emissions from 2022 to 2023.

For this reason, the new plastic tax will apply to all new plastic packaging that contains less than 30% recycled plastic.

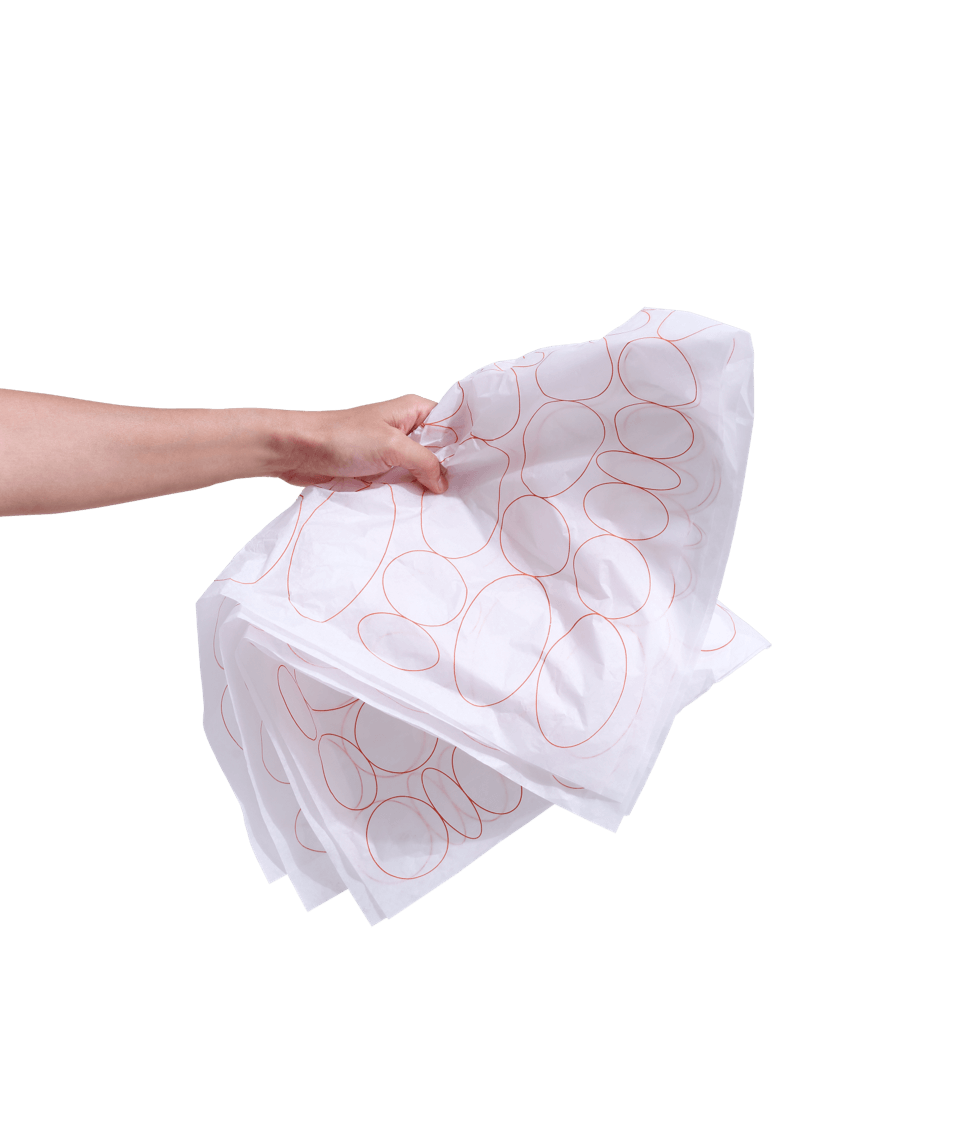

This includes plastic packaging manufactured locally and imported into the UK. It will affect both 100% plastic-based packaging (e.g., plastic mailer bags) and composite solutions, such as product boxes with plastic windows or casing.

What about bioplastic?

Does the PPT also cover compostable and biodegradable alternatives?

Afraid so. The consultation paper issued by the HM Treasury explains:

“The objective of this tax is to shift demand towards the use of recycled material, and therefore the government’s initial proposal is that the tax will not distinguish between different types of plastic or different ways of design for disposal.”

But it might not be time to throw your bio poly mailers on the compost heap yet. The definition is still up for review.

The weight factor

The other key element of the tax is the use of weight as a defining measure of the “content test”.

According to HM Treasury:

“Plastic packaging is packaging that is predominantly plastic by weight. It will not apply to any plastic packaging which contains at least 30% recycled plastic, or any packaging which is not predominantly plastic by weight.”

It’s a straightforward proposition for 100% plastic-based packaging, like plastic mailing bags, disposable food containers/wrappers and plastic retail packaging.

If the recycled content does not make up at least 30% of the total weight, then the £200 per tonne levy will apply.

It’s a little trickier when it comes to composite packaging.

In this case, you’ll need to check:

- the composition of the plastic component. Does it contain recycled content and how much?

- and whether the weight of the non-recycled component makes up more than 70% of the total weight.

So, a cardboard box with a small plastic window should be fine, but a plastic container with a cardboard pedestal tray will likely fail the test.

Things might get interesting with the good old jiffy bag.

But here’s the important part.

If an item of packaging fails the content test, the levy will apply to the weight of the whole packaging – and not just the plastic component.

Who will pay the PPT?

In terms of settling the accounts with HM Revenue and Customs (HMRC), the responsibility for paying the tax will fall upon UK manufacturers of plastic packaging and importers selling on the packaged goods.

But it is implied that this tax will be passed on down the line to the business customers of packaging suppliers and in turn, the end consumer.

So, no matter where you fall in the chain, the price of your plastic packaging will increase.

To keep costs down, a shift in business practices and behaviour will no doubt be required.

Who/what will be exempt?

The government is mainly focusing on the big end of town.

They have therefore stipulated that manufacturers or importers dealing in less than 10 tonnes of plastic packaging over a 12-month period will be spared from paying the tax.

The tax will not apply to durable and multi-use plastic packaging, such as food delivery containers or catering platter trays.

Plus, any plastic packaging used to transport imported goods will be exempt.

What do the changes mean for your business?

In the short term, the overall price of plastic packaging will likely increase as the industry shifts to recycled plastics.

That’s due to the fact that recycled plastic is around £500 more expensive per tonne than virgin plastic.

The PPT will also mean more paperwork, but only for manufacturers or importers processing more than 10 tonnes of plastic packaging over 12 months.

Leading up to 1 April 2022, you will need to assess your tax liability and whether your packaging meets the 30% recycled content test.

From 1 April 2022, liable companies will need to register with HMRC, submit returns on a quarterly basis and make payments accordingly.

Chris Barnard, Brighton Accountant at Accounts and Legal, gives some further advice for the large businesses that this tax will affect:

- The cost of compliance will be great and only large tax accountancy firms will have the scope to deal with these new rules, so ensure that your accountant is up to scratch.

- Companies will have to compare the costs of the new tax against costs for development and use non plastic packaging, which again will add costs for firms. Once you have this information you work with your accountant to make an informed decision on what is best.

- This may be an opportunity to carry out research and development to come up with new material and/or ways to package items going forward.

How to beat the tax by optimising your packaging

In the long run, it will be much better to limit your exposure to the tax in the first place. And the best way to do that is to look at your current packaging and apply the two Rs of sustainable packaging: Reduce and Replace.

Ordinarily, the other R of reusability would factor in the equation. But in this instance, it won’t help that much in minimising the effects of the PPT.

Reduce through Value Engineering

It’s amazing what you can achieve by re-analysing your packaging needs with fresh (green) eyes. All of a sudden what you once took for granted can look unnecessary and sometimes, just plain wrong. By asking the fundamental “why” questions around price, performance, security and assembly, you can often reduce your packaging without too much pain.

In the packaging world, this process is known as value engineering where you redesign your packaging from the ground up with the aim of reducing your environmental footprint and costs.

It’s kind of like the Marie Kondo method of decluttering the home.

Do you really need that bubble wrap? What value does that plastic divider bring? Does the packaging need to be that large to fit, protect and present your goods?

That would be one of your first steps to pass the 30% content test.

Chances are, your eco-conscious customer will most likely not miss the extra packaging and reward you for your efforts with their repeat business.

And the best part is that a reduction in packaging normally means a reduction in your unit costs.

Raylo, a London-based mobile phone startup, shows exactly how it can be done. They cut the weight of their delivery packaging by 25% and costs by 11% through value engineering.

They didn’t reinvent the wheel. They achieved this reduction by:

- Tailoring their packaging to the exact dimensions of their phones and accessories, which cut out any excess space and ensured greater security for the goods

- Reducing the thickness of the cardboard from three layers to two without compromising on robustness

While the material was corrugated cardboard, the process is the same for any packaging, including plastic or composite packaging.

Replace

If you can’t reduce the virgin plastic component of your packaging, then the next step is to look at replacing it.

With bio-plastics also affected, the obvious substitutes are recycled plastic and paper-based packaging.

Material science has come a long way in the packaging industry and now corrugated cardboard solutions can provide similar amounts of strength and protection as plastic packaging.

Cardboard can be also used as thermal insulation.

Take Psi Bufet, a D2C pet food company. With the help of packaging engineers, they developed an insulated shipping box for frozen food deliveries, which was made entirely out of cardboard.

Three-layer corrugated cardboard (B flute) provided the protection, while paper-based honeycomb inserts kept the temperature below zero during delivery.

No plastic was used. The box is 100% recyclable and biodegradable, while the cardboard is made from 90% recycled content.

Without the need for expensive insulation, their solution turned out to be 67% cheaper than other alternatives on the market.

The next step is to ensure that the paper or cardboard in your packaging is either recycled or made from sustainable sources.

The Sustainable Packaging Coalition is a great resource. Here, you can see the certifications of certain brands and products.

Likewise, the Forest Stewardship Council ensures that any wood-based products (like cardboard) are made from responsibly managed forests.

The PPT in a nutshell

- From 1 April 2022, a £200 per tonne levy will apply to plastic packaging where the recycled content does not make up at least 30% of the total weight.

- The tax applies to plastic packaging manufactured locally and imported into the UK.

- Composite packaging will also be affected if any plastic component makes up the majority of the total packaging weight and does not contain at least 30% recycled content.

- If an item of packaging fails the content test, the levy will apply to the weight of the whole packaging – and not just the plastic component.

- UK producers and importers of plastic packaging will foot the bill, but the price increase will likely be passed on to businesses and end consumers.

- Manufacturers or importers dealing in less than 10 tonnes of plastic packaging over a 12-month period will be exempted, along with durable and multiple-use plastic packaging.

- The overall cost of plastic packaging will likely increase in at least the short term.

- From 1 April 2022, liable companies will need to register with HMRC, submit returns on a quarterly basis and make payments accordingly.